The pressure on bank marketers to ensure an exceptional customer experience has never been greater. With innovative, customer-friendly alternatives to traditional bank offerings—such as those being provided by fintech organizations—banks have no choice but to keep up.

It’s not surprising, then, that many banks are considering investments in customer communications management (CCM) technology. The expectation is that the ideal CCM software solution should allow banks to better engage customers in more meaningful ways. For most banks, the goals are clear:

Access to the right customer data will be critical to the success of these efforts. Toward that end, InfoTrends and Messagepoint recently conducted a direct marketing survey to find out what works and why. For example, the InfoTrends survey found that more than 50% of respondents in all age demographics surveyed said personalization makes it more likely that they will open the direct mail they receive.

However, the research also revealed that more than 37% of the data that marketers need for effective, personalized campaigns is controlled by IT, rather than marketing. That means even simple customizations require a high degree of IT support and specialized programming expertise, which creates a nagging barrier for marketing in lines of business wanting improved personalization.

All this is driving the demand for CCM tools that will enable marketers in every industry, including banking, to overcome existing hurdles to accessing critical customer data.

One approach worth consideration is to leverage cloud-based software-as-a-service (SaaS) technologies that are agnostic to the delivery system and integrate with existing print composition and digital channels to accelerate the delivery of agile and personalized customer communications. Cloud-based CCM technologies are making it possible for business users—independent of IT—to access customer data to create, modify, and approve personalized customer messaging content and targeting rules in communications across channels.

Adopting an approach of this kind enables a collaborative, self-service ecosystem in which business users are able to access easy-to-use, web-based editing tools to enter or change communications content. Self-service proofing and testing can enable users to see what content will look like in real-time. It is also possible to define a web-based approval workflow to ensure that only the content changes approved by the appropriate person or persons make it into production.

In addition to streamlining personalization, security is another compelling reason to consider a cloud-based SaaS approach. For organizations desiring to keep customer or other sensitive data behind their firewall, a hybrid cloud model offers a means to get the flexibility of the cloud as well as the security of keeping data protected on-premise. SaaS hybrid cloud CCM solutions can address these concerns by ensuring that customer data is only required when digital communications are being generated at an organization’s premises or at its trusted print service provider.

Of course, banks should also make sure the hybrid cloud provider aligns with any applicable compliance and regulatory standards, provides secure connectivity, and follows the organization’s controls related to the access of customer data.

As organizations plan their customer communication strategies, it’s important to assess whether a SaaS CCM approach can integrate with existing delivery systems that the organization has already invested in.

To compete effectively, banks and other organizations need the ability to communicate new and personalized information quickly. Whether supporting marketing objectives or compliance, time to market with new information is more important than ever before.

The right SaaS CCM approach can offer a way to simplify the complexity that exists in the CCM infrastructure of most banking organizations, making it possible to deliver the agility and automation needed to ensure the highest levels of personalization and customer experience.

Giving you intelligent control over your content so you can deliver optimized, personalized, and compliant customer communications across…

Read the brochure

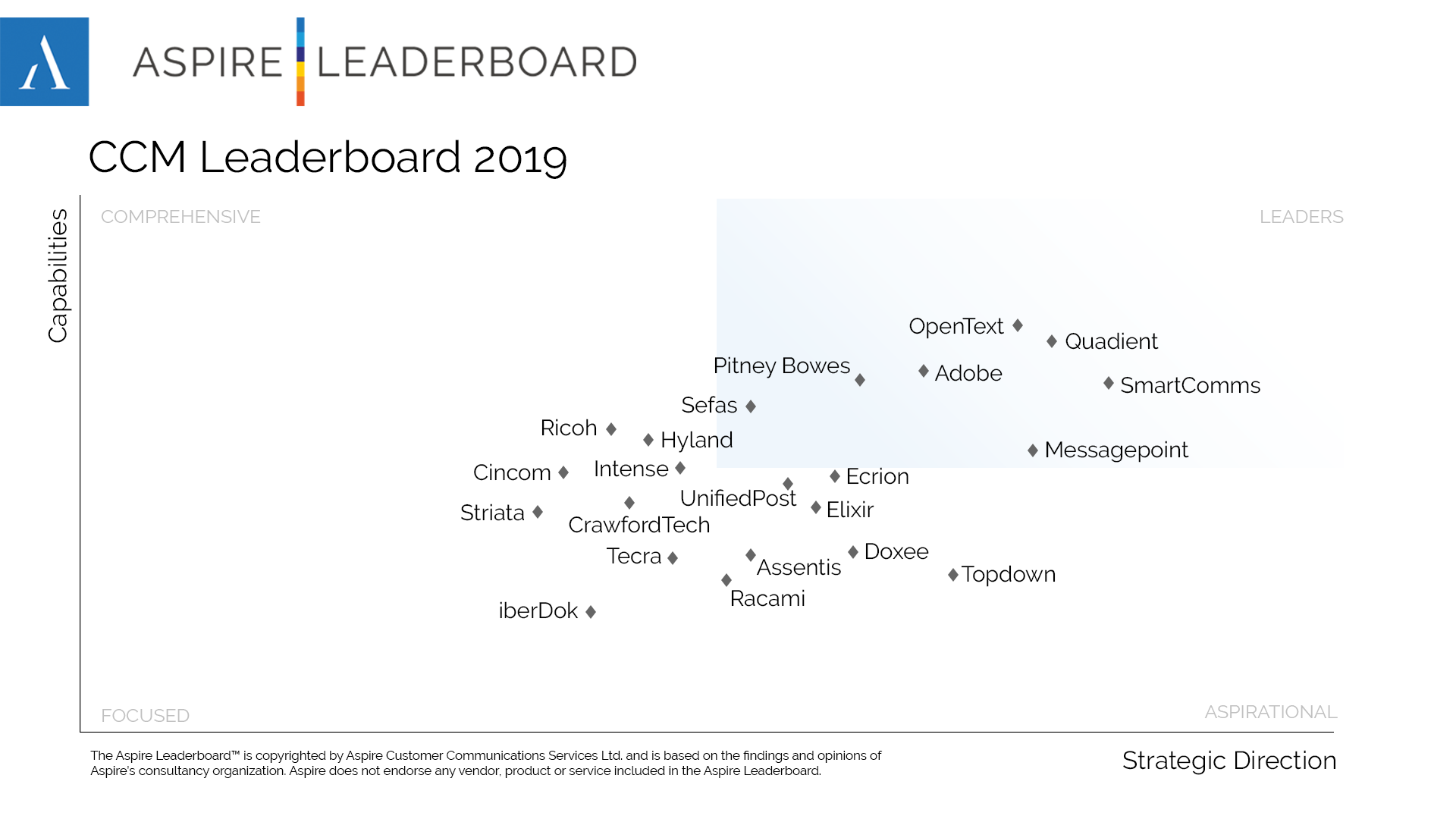

Messagepoint Inc. has been named as a leading provider of Customer Communications Management (CCM) solutions in the Aspire…

Read the article

The Content Intelligence Revolution – Part 2: Optimization & Assisted Authoring The CCM industry is at the…

Read the whitepaper