In 2016, the Harvard Business Review published a study revealing that effectiveness at fostering an emotional connection with customers is one of the top differentiators in a customer’s experience with a brand. Researchers discovered that companies implementing an emotional connection-based strategy across the entire customer experience—particularly how brands communicated with customers—experienced a noticeable increase in customer interaction, growth and loyalty.

Fast forward to 2020 and consider what has changed since that study was published. For one, the customer journey, particularly for financial services firms, crosses over many communication channels. Additionally, consumers now expect any transition to be seamless as they interact with brands through these various channels, often moving simultaneously from print to phone to web to live chat—and often doing so around a single customer service issue or purchase.

While banks have had some time to get used to these expectations, one thing we were little prepared for was the coronavirus outbreak. The complexity of this event, the heightened emotions and potential feelings of anxiety and stress, only serve to increase the importance of precise, effective communications with customers. Creating effective customer-facing content that fosters an emotional connection with customers, builds trust and alleviates fears requires the ability to weave three critical aspects into each communication: brand continuity, reading comprehension and sentiment.

Every marketer understands the value of adhering to their brand, and today this is more challenging than ever. We have so many more channels through which we communicate with customers, each one with its own unique attributes that can lend to or detract from the desired brand experience you are trying to create for a customer in their journey.

Research shows that branding consistency throughout that journey creates loyalty and trust, leading to increased revenues. One of the biggest challenges marketers face in achieving that consistency is that teams tend to operate in silos, in which different groups manage different channels, different campaigns and communications, all in different systems. This makes it more difficult to adhere to standards such as those relating to fonts, logo position, design aspects, language (restricted terms, use of contractions, etc.), messaging (salutations, product descriptions, corporate descriptions, etc.)—all of which are important factors that drive familiarity across your communications so the customer learns what to expect from your brand.

Use simpler words with fewer syllables, shorter sentences and paragraphs, remove jargon and use plain language that is easy to digest. An easy first step to reduce the complexity in your communications is to identify what words may be confusing to customers. Removing acronyms, industry jargon or overly technical terms can go a long way to helping your audience understand your message. This is a key aspect of adopting plain language, along with examining word length, character and syllable counts, sentence length and the time it takes to read your messages.

Commonly, financial services, insurance and healthcare organizations target a particular reading level for their communications, measured by the level of education one has to have to understand the text. While many strive to write for an eighth–grade reading level, writing at a fifth–grade level will help you ensure clarity and understanding for the vast majority of the U.S. population. Writing for adults at an elementary school level without coming across as condescending or overly simplistic is no small task.

Critically important in a crisis is the ability to communicate with customers in a way that evokes the desired feelings that will ultimately lead to a positive emotional connection with your customers. Communications sent from your bank to customers or prospective customers, such as notices, lending letters or marketing promotions, have the potential to damage a relationship if you don’t get it right. Do an “emotional spell-check” to analyze your writing and help determine if the words you are using will prompt the intended response.

Using words that elicit feelings of security, convenience or success in life can lead to a positive interaction with most type of banking communication for customers. Choose words that deliver the news in a neutral way to leave the door open for the future.

Emerging technology is now playing an active role in customizing communications that foster the response marketers are seeking. These technologies set up guardrails and assistance to look at brand alignment, reading comprehension and sentiment to ensure you are sending the right message. Software that uses artificial intelligence and machine learning can automatically assess the reading comprehension level of every message and alert you when you are out of alignment with the target reading levels profile for a certain type of customer touchpoint.

AI can also provide a sentiment analysis to help you ensure the right feelings and emotions are in play when authoring more complex communications. Additionally, AI helps ensure brand consistency and compliance, identifying elements of content that are out of compliance with an organization’s brand standards to ensure consistency across all communications and channels. Finally, providing a central place to control, collaborate and optimize content is also critical to drive consistency across channels. Without that, you may still have multiple teams controlling content in disparate systems with no way to drive content sharing and consistency.

How our customers experience our brands often is a result of whether we took the time to pay attention to details that may seem small. Taking the necessary steps to ensure that your communications are easy to digest, express the right sentiment and are consistent across all channels always plays an essential role in creating a memorable customer experience. Considering the challenging times we face currently with the COVID-19 pandemic, it is even more critical that banks pay careful attention to precise customer communications to ensure they contribute to positive, long-lasting connections.

Originally published in ABA Bank Marketing

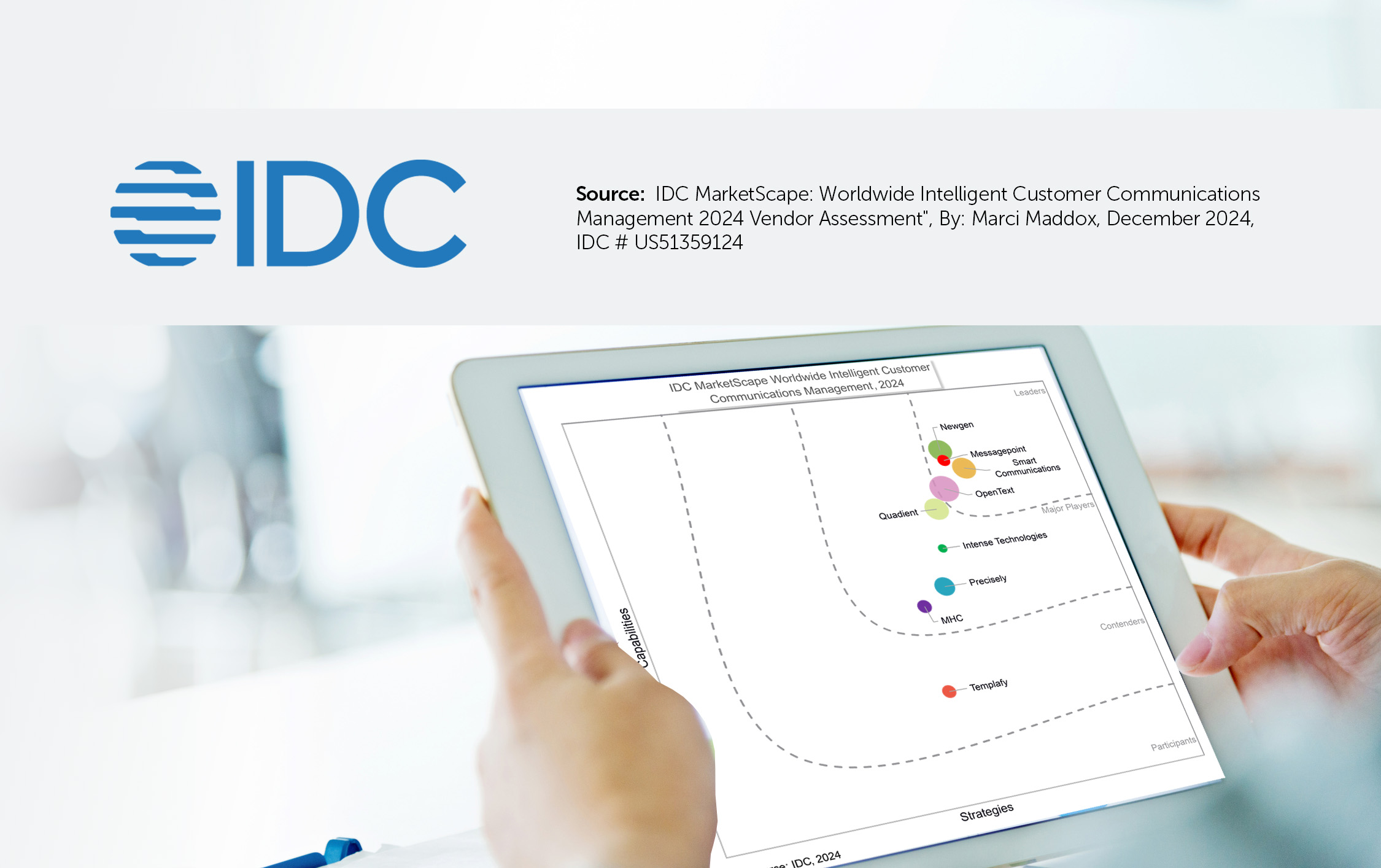

TORONTO, December 5, 2024 – Messagepoint Inc. announced it has been named a Leader in the IDC MarketScape:…

Read more

IDC’s MarketScape for Intelligent Customer Communications Management evaluates vendors that natively own or integrate forms technology and artificial…

Read the whitepaper

The mortgage servicing industry is under immense financial pressure. With interest rates high and home prices still rising,…

Read the Article