Most organizations today invest heavily in their customer experiences to avoid customer churn and the high cost of new customer acquisition. In times of crisis, when emotions are heightened and individuals are feeling insecure, continuing to provide active and supportive communication is even more critical.

In today’s digital age, where information can be distributed within minutes, customers are less likely to forgive a lack of communication, information, and guidance from your organization. In fact, recent research shows there is a great deal riding on how well you communicate with customers in stressful times.

A recent Harvard Business School study issued amid the COVID-19 pandemic demonstrates this point:

These responses are amplified when customers look to your bank to help them restore a sense of normalcy and security.

Think carefully as to how your business fared through recent events. While COVID-19 may have affected your employees’ ability to work regular hours in your office, easily access data files and otherwise function normally, a natural disaster such as a hurricane, tornado, flood, blizzard, or earthquake might also damage your physical facilities and infrastructure. Other threats can include data breaches, terrorist attacks, even scandals involving your employees or other public relations disasters. How prepared is your bank for these types of events?

Let’s consider teams at three different levels of preparedness—and the outcome.

The first team was able to adapt quickly to its employees working remotely—everyone from content authors and IT teams to customer service reps. They communicated with customers immediately using pre-designed communications and messaging that was clear, accurate, and helpful to customers about service interruptions and they provided reassurance that they were there for their clients. In many cases, this level of preparedness is enjoyed by large, well-established corporations that may have experienced earlier crisis situations, have focused on alternative operational issues, and have processes in place in case of natural disasters and other threats.

The second organization was caught as short as its clients. It did not have content or communications ready to adapt for an unforeseen crisis. It had to outsource the creation of crisis communications and messaging to let its customers know about changed business hours, closed branches, and new procedures. This took longer than was ideal, delaying the routing of information to customers and costing more than it should have. Frustrated customers eventually received the information they needed, but only after the organization sorted through the confusion and an influx of inquiries to the call center.

The third organization failed to update its communications to reflect the current circumstances of the pandemic. In the first two months of the pandemic, the credit card statements and website still promoted travel offers and made no mention of lower interest rates and payment deferral programs being publicized in the news. The same situation occurred for its mortgage customers, leading to confusion about rates and options for those financially impacted by COVID-19. In times of uncertainty, when customers are facing financial hardship and health risks, it is critical that communications be clear and consistent. These excellent programs designed to help customers could have had a broad-reaching positive impact for the bank’s brand if they were communicated quickly, clearly, and consistently.

Many large organizations have invested a lot of time and planning to make sure they are prepared for a crisis. They’ve planned for IT failures with data centers located in disparate locations and have set up redundant, accessible, and secure cloud-based databases and archives. However, their preparation doesn’t necessarily extend to their customer-facing communications systems, processes, and messaging. Here initial steps are needed to be prepared to communicate the unexpected.

Stock your communications pantry. You can’t anticipate the exact nature of all crises that will arise, but you can prepare for the unexpected by having templates and some pre-authored content ready to go.

Begin by analyzing the various kinds of scenarios you might need to respond to and the corresponding communications and messages you will need to send to customers affected and to those not affected. Consider how you may need to adapt communications for different groups and how to facilitate this easily. For example, you may need to deal with internal, local, regional, national, and global crises. Decide which media channels you need to have available to you and whether they include broadcast communications, interaction with customers through your customer service representatives, messaging tailored to specific customer groups or supportive messaging included in your routine communications. For the latter, you’ll need to leave adequate space for the insertion of content in emails, letters, invoices, statements, landing pages, or other communication vehicles.

Now the important part: Start to build a content and communications library. Pre-author communications and content for multiple scenarios and have them approved and ready to go. These content blocks should be ready to be dropped into pre-built communication templates that can be modified and sent out quickly.

Pay attention to your message. During times of crisis, emotions are heightened. Though your normal branding style might be casual, attempts at humor or lightness during a crisis will come across as insincere and insensitive. Similarly, a formal tone from a conservative financial services organization may appear too cold and uncaring. Too much emphasis on negativity or risk instills fear and uncertainty in your customers. Although some messages may need to relay negative news, this should be presented in a neutral way, with assurances that your organization cares about the customer and is making efforts to be supportive. Essentially, customers want to be reassured that you have your approach to the situation under control.

Research has proven that in times of crisis, people don’t want to receive a hard sell message, which can appear exploitative. They do want to hear from product experts or the CEO and want information about how your business is managing the crisis. In some cases, as in a data breach, customers need to know whether there will be any impact to them and if so, what will it be? And what is your organization doing to help them? Rather than cobbling together an announcement or message under stress and in a rush, this is where giving thought to content beforehand is so valuable. Though it may seem difficult to create appropriate content before experiencing the disaster, it is useful to develop a library of messages that can be modified to suit the specific situation.

Finally, to build and maintain customer loyalty, it’s important to protect your brand standards so that your communications look and sound like they are coming from your organization. If you outsource your communications in a rush, there is a risk that they may not be aligned with your brand, which is critical, particularly in this age of phishing, to ensure your customers recognize and trust your communications. Also, avoid using sensational headlines or providing “click here” links in email or text communications that again might result in an influx of calls into your call center or result in your communication being ignored altogether as a phishing attempt.

How you respond matters. A perfect world would be crisis-free, or at least give us fair warning in time to circle the wagons. Unfortunately, that’s rarely the case. For organizations that work to establish intimate and long-term relationships with customers, it’s important to keep communication channels open, active and relevant through stressful times, assuring clients that you understand their concerns and are doing what you can to support them.

While it’s imperative to have your hardware and systems up and ready to respond, your communications—what you say and how you say it—are just as important as being able to deliver the message.

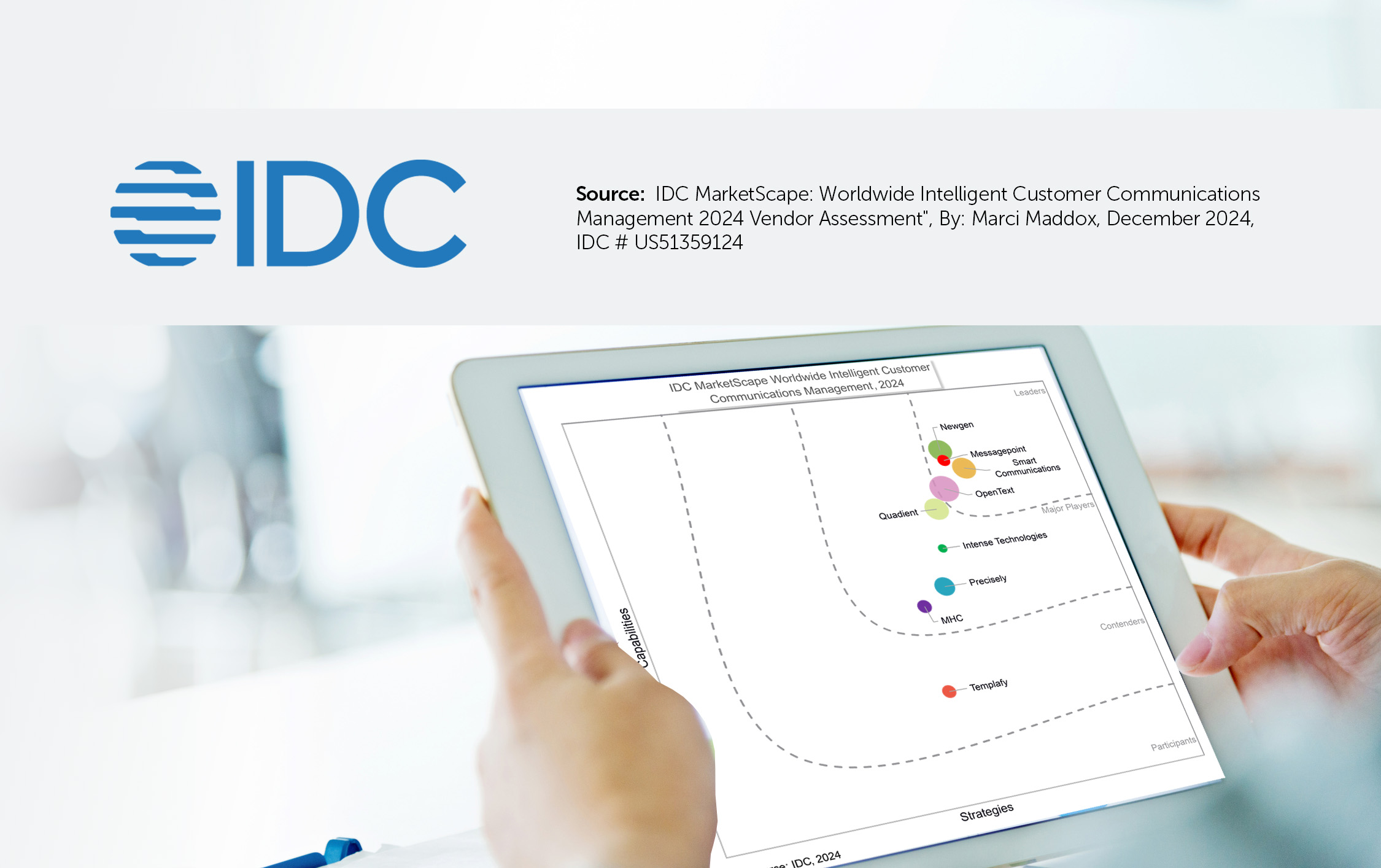

TORONTO, December 5, 2024 – Messagepoint Inc. announced it has been named a Leader in the IDC MarketScape:…

Read more

IDC’s MarketScape for Intelligent Customer Communications Management evaluates vendors that natively own or integrate forms technology and artificial…

Read the whitepaper

The mortgage servicing industry is under immense financial pressure. With interest rates high and home prices still rising,…

Read the Article